Elsa Overview

TL;DR

Elsa is the crypto agent layer that turns intent → action.

Users (and partners) issue goals; a multi-agent system plans, validates, and executes across chains safely, autonomously, and at scale.

Overview (What is Elsa?)

Elsa makes DeFi feel like typing a message.

Three surfaces, one engine:

- Copilot (B2C): Chat to swap, bridge, stake, hedge, farm, set automations.

- Widget & SDK (B2B): Embed “trade with AI” inside any wallet, dApp, or content app.

- AgentOS: Build/host specialized agents on a shared Agent-to-Agent (A2A) coordination bus.

Overview (What is Elsa?)

Elsa makes DeFi feel like typing a message.

Three surfaces, one engine:

- Copilot (B2C): Chat to swap, bridge, stake, hedge, farm, set automations.

- Widget & SDK (B2B): Embed “trade with AI” inside any wallet, dApp, or content app.

- AgentOS: Build/host specialized agents on a shared Agent-to-Agent (A2A) coordination bus.

What this litepaper covers (Preview)

- Vision → Autonomous DeFi: From on-demand execution to self-driving portfolio actions (take-profit, hedging, rebalancing, APY hopping).

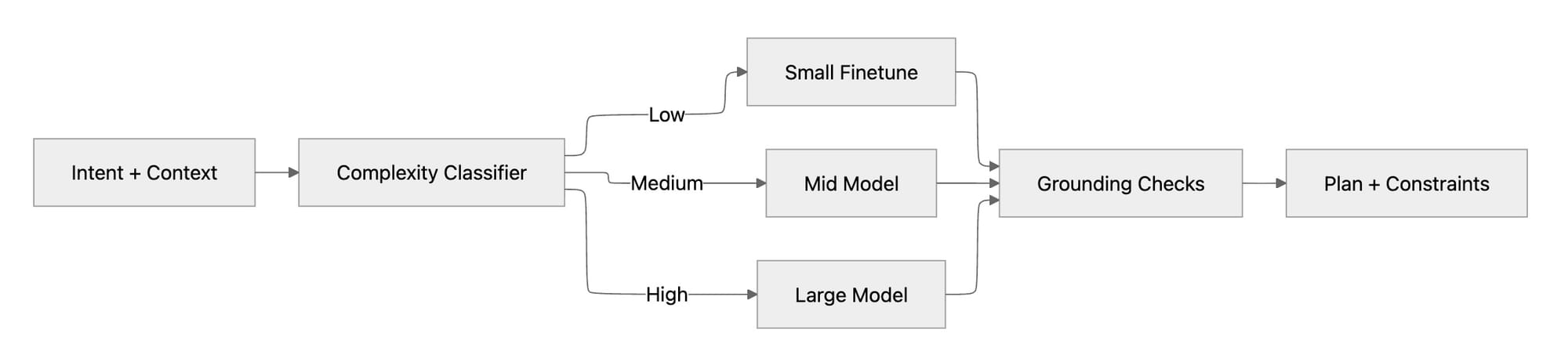

- Multi-LLM Orchestration: Route tasks by complexity/latency to the right model; verified, grounded outputs.

- A2A Communication Layer: Specialized agents coordinate, bid for work, and share context.

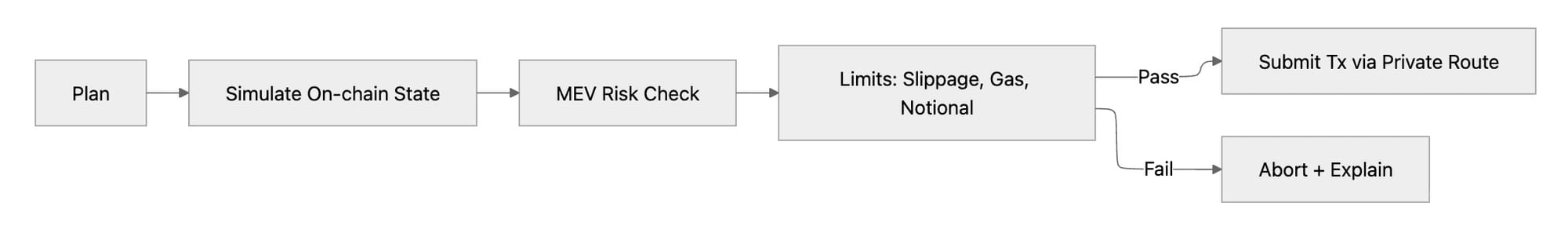

- Execution & Safety: Simulation, guardrails, MEV-aware routing, receipts, and proofs.

- Cognitive Cache: Privacy-preserving memory for personalization without leakage.

- Build on Elsa: Agent OS, SDKs, embeddable widget; host your own agents and monetize.

Technical Architecture (Layered)

Bottom → Top

- Data & GroundingOn-chain state (nodes/indexers), oracles, curated KB; freshness checks & anomaly detection.

- Execution LayerPre-audited scripts, simulation, route selection (DEX/bridge meta-routers), MEV-safe submission, idempotency, receipts, telemetry.

- Agent LayerComposable specialists (Swap, Bridge, Yield, Risk/Hedge, Perps, NFT, Sniper, Alerts). First-party + hosted third-party agents with scoped permissions & SLAs.

- A2A Bus (Coordination)Pub/sub messaging, contract-net bidding, plan aggregation, reputation, fairness scheduling.

- Orchestration (Multi-LLM + Planner)Task classification → model routing (small/mid/large). Strategy synthesis, constraint solving, fallback/hedged inference.

- Intent Layer (NL Interface)Parsing, slot-filling, constraint capture, policy hints, multi-turn context & disambiguation.

- Safety & PolicySimulation gates, allow/deny lists, max-notional limits, geo/KYC hooks, verified inference (zkTLS/MPC-TLS).

- Cognitive CacheTEE-backed private memory of preferences, behaviors, outcomes; accelerates planning & personalization.

- ObservabilityTraces, metrics, audit logs, anomaly detection, circuit breakers.

How the three surfaces map onto the stack

- Copilot: Intent → Orchestration → A2A → Agents → Execution(Safety, Cache, Grounding applied throughout)

- Widget & SDK: Partners attach at Intent/Orchestration with their context; reuse the same A2A, Agents, Execution.

- Agent OS: Lives inside Agent/A2A layers; provides SDKs, sandboxing, manifests, reputation, and monetization for hosted agents.

Layers, Policies & Safety

Intent Layer

Role: Natural-language interface that converts user input into machine-readable intents with constraints.

Responsibilities

- Parse NL (text/voice) into structured

Intent{verb, objects[], params{}, constraints{}, riskHint}. - Slot filling (amounts, assets, chains, time horizons, targets) with uncertainty scores.

- Constraint capture: risk limits (max slippage, LTV caps), compliance (geo/KYC), budgets, deadlines.

- Context injection from Cognitive Cache (prefs, past approvals, favorite chains/pools).

Inputs → Outputs

- In: NL prompt, wallet context, session policy, cache profile.

- Out: Validated intent JSON + confidence; missing-slot prompts if needed.

Key Components

- NER + typed entity registry (tokens, chains, protocols).

- Canonical schema & versioning (e.g.,

v3.intent.swap,v2.intent.yield.optimize). - Guardrails (regex, allow-lists, refusal rules for unsafe verbs).

Failure Modes / Handling

- Low confidence → ask clarifying question.

- Ambiguous asset/chain → propose top-3 disambiguations.

- Out-of-policy verb → safe decline with rationale.

Orchestration Layer

Role: Decides how to satisfy an intent: routes to the right model(s), synthesizes a plan, assigns agents, and sets up A2A messaging.

Responsibilities

- Task classification (complexity, domain, required latency, risk class).

- Multi-LLM routing (small/mid/large or toolformer) with cost/latency budget.

- Plan synthesis: decompose into steps with pre/post-conditions and success metrics.

- Agent assignment & capability matching; create A2A contracts for cooperation.

Inputs → Outputs

- In: Intent JSON, cache profile, live data pointers (oracles/indexers).

- Out:

Plan{steps[], dependencies[], SLAs, fallbackPaths[], evalFns[]}+ agent roster.

Key Components

- Classifier features: task complexity, risk class R0–R3, latency budget, chain/protocol access, wallet approvals needed, MEV exposure, statefulness needs.

- Routing policy (see section below).

- Planner (STRIPS-like) with constraint solver (fees, gas, liquidity, bridge risk).

Failure Modes / Handling

- No feasible plan → return alternatives (cheaper chain, different pool).

- SLA breach predicted → downgrade model, simplify plan, or defer.

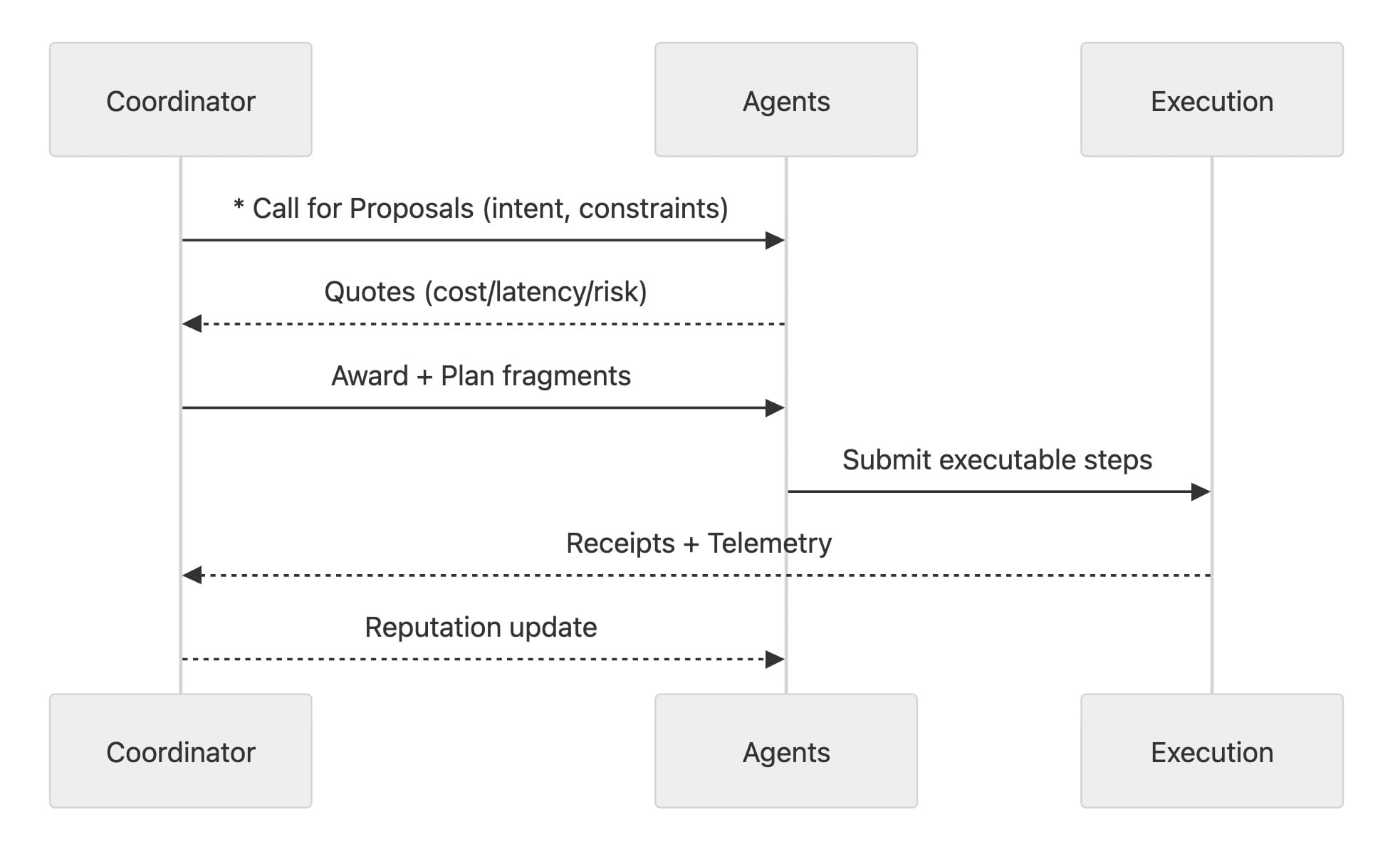

A2A Bus (Agent-to-Agent Communication)

Role: Contract-Net style coordination for multi-agent work; pub/sub plus scheduling and reputation.

Responsibilities

- Matchmaking: broadcast sub-tasks; agents bid/commit with price/SLA.

- Reputation & scheduling: track success, latency, accuracy; prioritize reliable agents.

- Message semantics: idempotent commands, retries, exactly-once task receipts.

Key Components

- Topics:

swap.quote,bridge.route,stake.position,risk.hedge,perps.open,alerts.set. - Message types:

rfq,proposal,award,work.start,work.done,work.fail. - Safety: per-task scopes, least-privilege creds, time-boxed leases.

Agent Layer

Role: Composable specialists that execute parts of a plan.

Core Agents

- Swap Agent: DEX quoting, split routes, slippage control.

- Bridge Agent: Route selection (risk/fee/time), proof checks, stuck-tx recovery.

- Yield Agent: APY scan, IL/risk modeling, auto-compound, vault migrations.

- Risk/Hedge Agent: Perps/options, stop-loss/TP, delta hedging.

- Perps/NFT/Sniper/Alerts: Venue-specific execution, floor sweeps, limit/cancel/IOC, event watchers.

Interfaces

- Capability manifests (supported chains, tokens, max notional, expected latency).

- Deterministic simulation hooks for pre-trade checks.

- Telemetry contract: step outcome, gas used, PnL, confidence, anomalies.

Execution Layer

Role: Turns approved plans into on-chain transactions safely.

Responsibilities

- Pre-audited scripts per protocol (param-bounded).

- Transaction simulation (fork or RPC sim) with revert reason capture.

- Meta-routing: 0x/CoW/UniswapX/1inch; bridge aggregators; batching.

- MEV safety: private relays, back-run protection, non-arb bundle rules.

- Settlement & receipt collation; retries with nonces/gas bumping.

Outputs

ExecutionReport{txids[], status, receipts[], realizedSlippage, fees, proofs}.

Cognitive Cache

Role: Private memory for speed and personalization.

Contents

- Preferences (risk, fee sensitivity, favored chains/pools).

- Behavioral features (time-of-day activity, asset affinities).

- Allowances & trusted protocols.

- Summarized wallet history (positions, cost basis, PnL bands).

Controls

- TTLs & decay, user export/delete, per-scope consent, encryption at rest.

Benefits

- Fewer clarifications, better defaults, faster routing.

Safety Layer

Role: Proves what we know, enforces what we allow.

Grounding

- Live on-chain state (indexers/full nodes), oracles (prices/liquidity), curated KB (audits, risk advisories).

- Every recommendation/check passes

GroundingEngine.validate().

Policy Engine

- Geo/KYC, protocol allow-lists, notional/risk caps, leverage ceilings, counterparty filters.

Verified Inference

- zkTLS / MPC-TLS proof adapters for “this insight came from these sources at time T” without exposing raw logs.

Simulation & Dry-Run

- Pre-execution sims with guard conditions and stop-if rules.

Observability

Role: Make intents→actions traceable and operable.

What’s tracked

- Traces with span IDs from intent parse → plan → A2A → execution → receipts.

- SLAs/SLOs per step (p50/p95 latency, success rate, cost).

- Audit logs for all policy decisions and escalations.

- Anomaly detection (stuck bridge, abnormal slippage, oracle drift).

Surfacing

- Operator dashboards, partner webhooks, user-visible receipts.

Classifier Features (expanded)

- Task complexity: single-step vs multi-leg, cross-chain, approvals required.

- Risk class (R0–R3): read-only → low-risk swap → leveraged/perps → protocol-novel/high-risk.

- Latency budget: sub-second (quotes) to minutes (bridges) vs deferred (rebalances).

- Chain access: wallet approvals, token allowances, supported venues/bridges.

- Market context: volatility, liquidity depth, MEV risk bands.

- User profile: fee sensitivity, risk tolerance, preferred venues.

Routing Policy (multi-LLM)

- Fast / transactional (balances, prices, parameter extraction) → small finetunes (low latency, tool use).

- Analytical (yield comparisons, pathfinding, risk scoring) → mid models with tool-augmented RAG.

- Strategic / autonomous (multi-leg plans, portfolio mgmt, hedging) → large models with planning + constraint solving.

- Cost/latency governors: per-request budgets; degrade gracefully under load.

Grounding Pipeline

- Fetch: on-chain (nodes/indexers), oracles (price/liquidity), curated KB (audits, risk lists).

- Validate: cross-source consistency checks, freshness thresholds, quorum rules.

- Attach: include

groundingRefin every recommendation/action. - Prove: optional zkTLS/MPC-TLS proof artifact for partner/user verification.

Verified Inference

- What: Cryptographic proofs that a model’s answer was derived from stated inputs and logs.

- How: Proxy TLS via zk/MPC adapter; store digest; emit verifiable receipt with the response.

- Where used: High-stakes advice, partner compliance, dispute resolution.

Fallbacks & Hedging

- Model timeouts: reroute to smaller model; summarize; request user confirmation if confidence < threshold.

- Execution hedging: secondary routes/venues; split orders; time-slice in volatile markets.

- Dual-run critical plans: plan via large model, cross-check via mid model; reconcile conflicts.

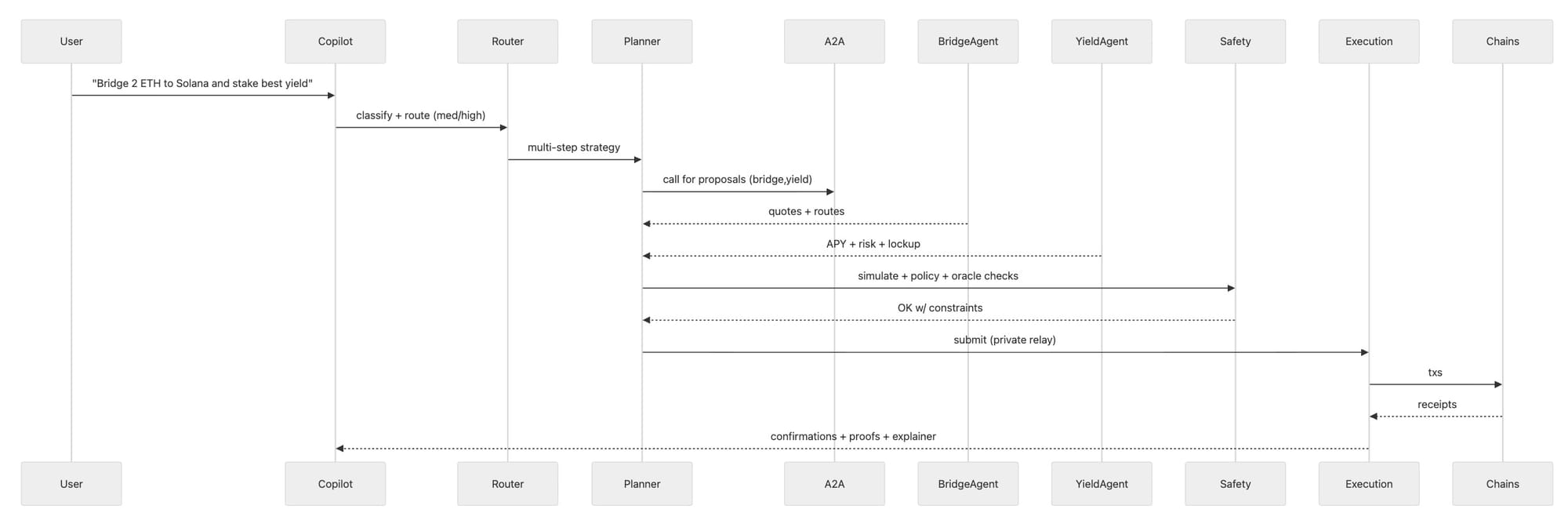

Example Intent → Action (concise)

- User: “Bridge 2 ETH to Solana and stake for safest yield.”

- Intent Layer:

intent.yield.optimizewithamount=2 ETH,dstChain=Solana,risk=low. - Orchestration: classify

R2, route mid/large model → plan: {swap? no, bridge via Wormhole, stake Solana pool A}, SLAs. - A2A Bus: RFQs to Bridge Agent + Yield Agent; award best proposals.

- Execution: simulate bridge + stake; private submit; collect receipts.

- Safety: ground rates/APY; enforce policy caps; attach proof.

- Observability: log trace; show user receipts + realized APY baseline.

- Cache: update prefs (Solana OK, low-risk yield).

Schemas (abridged)

Intent (v3)

{

"verb": "yield.optimize",

"objects": [{"asset":"ETH","amount":"2"}],

"params": {"dstChain":"solana","risk":"low"},

"constraints": {"maxSlippageBps":50,"deadlineSec":900},

"profileRef":"cache://user/123",

"policyScope":"retail.low",

"version":"v3"

}

Plan (v2)

{

"steps":[

{"id":"s1","type":"bridge","route":"wormhole","from":"ethereum","to":"solana"},

{"id":"s2","type":"stake","venue":"solend","asset":"SOL","policy":"lowRisk"}

],

"dependencies":[["s1","s2"]],

"sla":{"p95LatencyMs":30000},

"fallbacks":[{"on":"bridgeFail","route":"portal"}]

}

SLAs / SLOs (suggested)

- Intent parse p95 < 400ms; plan synth p95 < 1.5s (analytical), < 4s (strategic).

- Quote freshness < 3s; simulation success > 99%; execution success > 98% (with retries).

- Max realized slippage ≤ quoted + policy buffer (e.g., +15 bps).

- A2A task award latency p95 < 800ms; agent failure rate < 1% per 1k tasks.

Policy Defaults (retail tier)

- Max leverage 3×; LTV ≤ 60%; single-venue exposure ≤ 40% per action.

- Bridge preference: audited routes; fallback only with user confirm (R3).

- New protocol cool-down: require audit flag or manual review.

If you want, I can convert this into a Notion page export (as Markdown with toggles) or wire it into your existing data room structure.

Build once; get execution + safety + distribution.

- SDKs: TypeScript/Python — intent schemas, on-chain connectors, simulation, policy hooks.

- Lifecycle: register → advertise capabilities → receive tasks → emit plan fragments/quotes/tx payloads → execute → report outcomes.

- Sandbox: per-agent runtime, quotas, scoped permissions (least privilege), secrets isolation.

- Scheduling: capability matching + live load + reputation.

- A2A messaging: pub/sub topics (

quote,plan,risk,exec,status) with signed envelopes.

Agent Manifest (example)

name: yield-agent

version: 1.2.0

capabilities:

- chain: [base, ethereum, solana]

- actions: [scan_yield, allocate, compound, exit]

sla: { p95_latency_ms: 1000, success_rate: 0.995 }

cost_model: { pricing: per-plan + per-exec }

permissions: { scopes: [simulation.read, protocols.write:yield, quotes.read] }

Why: multi-specialist coordination for complex workflows.

- Protocol

- Envelope: signed JSON (

msg_id,parent_id,topic,payload,ttl,sig). - Transport: NATS/Kafka-class pub/sub (durable streams), secure WS for interactive co-planning.

- Contract Net: broadcast CFP; agents bid; coordinator selects on price/latency/reputation.

- Consensus: weighted voting on conflicting plans (reputation × recency × scope-fit).

- Idempotency:

(intent_id, step_id).

- Envelope: signed JSON (

- Trust & Reputation

- Metrics: accuracy, timeliness, slippage vs quote, failures, user feedback.

- Decay to favor recency; quarantine/slash malicious or failing agents.

- Pathfinding: 0x / CoWSwap / UniswapX / 1inch meta-routing; bridge selector; order-splitting.

- Simulation: dry-run with pool state; bounds checks (minOut, gas ceiling, deadlines).

- MEV: private relays/bundles; price impact caps; back-run detection.

- Accounts: AA/ERC-4337; session keys; MPC/HW wallet support.

- Risk: dynamic slippage; conditional stops; liquidation buffers.

- Receipts: tx hash, logs, realized slippage, fees, route, quotes vs fills.

- Idempotency: replay-safe by

(user_id, intent_id, step_id).

- Content: prompt history, wallet behaviors (chains, protocols, risk), strategy outcomes.

- Store: vector DB (embeddings) + key/value features.

- Use: disambiguation, defaults, constraint inference, few-shot exemplars.

- Privacy: TEE-backed; per-user scope; opt-in research sharing; differential privacy on aggregates.

Excalidraw brief: circular cache feeding router with “known preferences”, “risk profile”, “recent strategies”.

- Sources: on-chain nodes/indexers; oracles (price/TVL); curated KB (audits/safety).

- Validators: cross-source reconciliation, freshness, anomaly detection.

- Policy engine: denylist, chain allow-lists, max notional, KYC/geo hooks.

- Proofs: zkTLS/MPC-TLS adapters to prove gateway authenticity.

- Explainers: every block/reject returns a human-readable reason.

- Modes: execute now; schedule; autopilot (bounded by policies).

- Features: swaps, bridging, staking, perps (roadmap), copy trading, prediction markets, yield optimizer, sniping/limits, NFT trade & limit.

- Personalization: risk bands, chain prefs, fee sensitivity, favorites.

- Outcomes: ~$100M total volume; 30M+ prompts; higher retention via context.

Widget (drop-in)

- Embed:

<iframe src="<https://app.heyelsa.ai/widget?partner=XYZ&theme=dark>" /> - Prefill context (asset/chain/flow)

- Callbacks:

onQuote,onTx,onError,onComplete

SDK (agents & flows)

- Intent schema, plan API, simulation, submitTx, receipts

- Policy templates, sandbox scopes, quota mgmt

- Theme/tone overrides

import { Elsa } from "@elsa/sdk";

const elsa = new Elsa({ apiKey: process.env.ELSA_KEY });

const intent = {

type: "yield.optimize",

amount: "500",

asset: "USDC",

constraints: { chain: "base", maxSlippageBps: 30 }

};

const plan = await elsa.plan(intent);

await elsa.simulate(plan.id);

const receipt = await elsa.execute(plan.id);

- Verification: conformance tests (correctness/latency), replay suite, adversarial sims.

- Runtime: CPU/mem quotas, topic rate limits, cost ceilings.

- Monetization: per-plan/per-exec pricing (USDC/$ELSA), rev share on partner volume.

- Metrics: intent→plan→exec funnel, p50/p95, slippage distribution, failure taxonomy, per-agent SLOs.

- Tracing: distributed trace IDs across router/agents/execution.

- Alerts: anomaly detection (slippage spikes, oracle drift), circuit breakers.

- Audit: immutable logs for compliance & partners.

- Wallets: MPC + HW; ERC-4337 AA; session keys with ceilings.

- Exec: allow-list bridges/routers; private flow; expiring quotes; gas caps; reorg-aware confirmations.

- Inference proofs: zkTLS/MPC-TLS verifier endpoints.

- Data privacy: encryption at rest; TEE for cognitive cache; opt-in telemetry.

- Router: p95 < 300ms (low/med), < 900ms (high).

- Plan→Simulate: p95 < 1.2s (single-chain), < 2.5s (cross-chain).

- Quote accuracy: ≥ 99.0% within bounds.

- Execution success: ≥ 99.2% after retries.

- Throughput: 200–500 intents/sec (horizontally scalable).

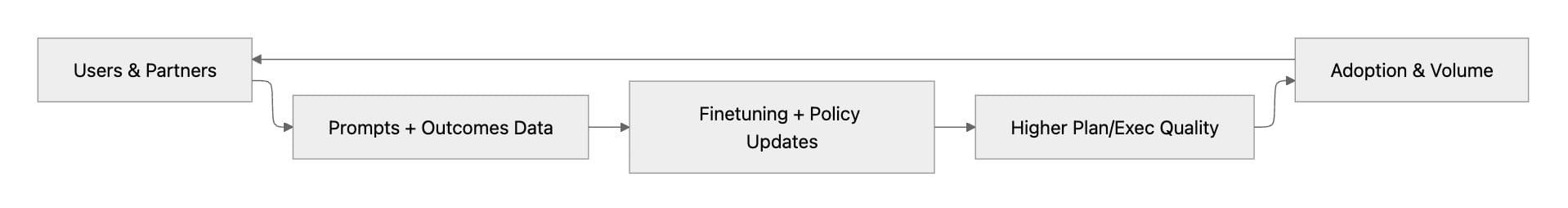

More users → richer prompts & outcomes → better finetunes → higher plan/exec quality → more partner conversion → more users.

Retail: “Bridge 2 ETH to Solana and stake best yield”

iFrame Widget

- Paste snippet, set partner key, theme/tokens/chains.

- Subscribe to callbacks for analytics/incentives.

SDK

- Install, create intents, plan/simulate/execute, display receipts.

- Apply policy templates (max notional, allow-listed routers, geo limits).

Host Your Agent

- Publish manifest, pass conformance tests, get sandbox scopes.

- Receive A2A tasks; earn per plan/exec.

POST /v1/intents

{

"type":"swap",

"user":"0x...",

"params":{"sell":"ETH","buy":"USDC","amount":"1.0","chain":"base"},

"constraints":{"maxSlippageBps":30,"deadlineSec":90}

}

GET /v1/plans/{intentId}

# returns steps, quotes, risk, agents, policy gates

POST /v1/execute/{planId}

# returns tx receipts, route, realized slippage, gas

mutation {

createIntent(input:{

type: YIELD_ALLOCATE,

asset: "USDC",

amount: "500",

chain: BASE

}) { id status }

}

- System Layers: rectangle bands for Intent, Orchestration, Agents, Execution; sidecar “Safety”; circle “Cognitive Cache”.

- A2A Market: central “Coordinator” node; multiple Agents bid; arrows for CFP/quotes/award.

- Safety Gates: funnel: Plan → Sim → Policy → MEV → Submit.

- Flywheel: circular loop of Users → Data → Finetune → Quality → Adoption.

Problem

Crypto is powerful but unusable at scale.

- Too many chains, tools, and workflows

- High cognitive load for basic actions

- Manual execution leads to poor outcomes

- Automation exists, but isn’t accessible

Most users don’t need more protocols — they need better execution.

Solution

Elsa introduces an AI-first execution layer.

Users express intent.

Elsa executes it.

- Natural language → onchain actions

- Optimized routing across chains and protocols

- AI agents manage trading, yield, and risk

- Automation without sacrificing control

Elsa abstracts complexity while preserving transparency.

Product Stack

B2C: Elsa Copilot

- Swap, bridge, stake, borrow

- Perpetual trading and copy trading

- Yield optimization and portfolio automation

- Smart alerts and agent-driven execution

B2B: Elsa Infrastructure

- Widget and iframe integrations

- SDKs for apps and wallets

- Agent execution APIs

- Revenue-sharing distribution model

Business Model

Elsa is usage-driven, not speculation-driven.

Revenue sources:

- Transaction fees on execution

- AI agent commissions

- B2B SDK and widget licensing

- Inference and execution fees

As execution volume grows, revenue scales naturally.

Token Overview

| Parameter | Value |

|---|---|

| Token | $ELSA |

| Total Supply | 1,000,000,000 |

| Decimals | 18 |

| Network | Base |

$ELSA is a utility token, powering execution, inference, and access.

Utility of $ELSA

$ELSA is the economic backbone of Elsa.

Fee Discounts

- Reduced execution fees for holders and stakers

Feature Access

- Unlock premium agents (copy trading, sniping, cognitive cache)

Gas Abstraction

- Gas-free transactions within Elsa using $ELSA

Inference & Execution

- AI model inference

- Onchain agent execution

- B2B SDK and widget usage

Utility scales with real platform usage.

Token Allocation & Vesting

| Category | Allocation | Vesting |

|---|---|---|

| Team | 7% | 12m cliff, 24m linear |

| Foundation | 34.490% | 20% TGE, 10m cliff, 24m linear |

| Community | 40% | 20% TGE, 48m linear |

| Pre-Seed | 1.4% | 12m cliff, 24m linear |

| Seed | 9.11% | 12m cliff, 24m linear |

| Liquidity | 8% | 100% at TGE |

Community-first allocation with long-term alignment.

Roadmap Snapshot

Up to Q2 2025 (Completed)

- Public beta live

- Core DeFi Copilot launched

- $1M+ daily volume

- 300K+ MAUs, 700K+ signups

- Monetization enabled

Q3–Q4 2025

- Perpetuals via Hyperliquid

- Copy trading and sniping agents

- Yield vaults and automation

- Mobile apps (iOS & Android)

- Multi-agent orchestration

- $ELSA Token Generation Event

- Token utility activation

2026

- Fully autonomous portfolio management

- Tokenized crypto indices

- Agent Builder SDK

- Automated strategy marketplace

- Cross-chain execution kits

- B2B scale across wallets and apps

Design Philosophy

- Execution > speculation

- Utility before governance

- Demand-backed token economics

- AI that acts, not just advises

Elsa is built for scale, automation, and real usage.